China's Post-COVID Recovery Continues

When thinking about prospects for the Chinese economy, one of the most important factors is whether the coronavirus remains under control. China’s continued its post-Covid recovery in May, with consumer spending, manufacturing and investment all bouncing back strongly. But when will a return to normal happen?

"Because China is a domestic-demand driven economy, there is a low risk that a possible COVID-driven global recession, or the on-going downward spiral in U.S.-China relations might derail the recovery."

China's post-COVID recovery continued in May, with consumer spending, manufacturing and investment all bouncing back strongly. With the virus largely under control three months after the lockdown was eased, further progress is likely, although a return to normal may not happen until next year. In their April World Economic Outlook, the IMF forecasts that in 2020, China and India will be the only major markets delivering year-over-year economic growth, and in 2021, the Fund projects that China, India and the five major ASEAN countries (Indonesia, Malaysia, Philippines, Thailand and Vietnam) will be the world's fastest growing economies, on a YoY basis.

All of us at Matthews Asia send our sympathies to everyone effected by COVID-19, either directly or indirectly, and we extend our gratitude to all health care professionals, scientists and service providers who are diligently working to help and provide care to those in need around the world.

Progress towards controlling COVID-19 is key

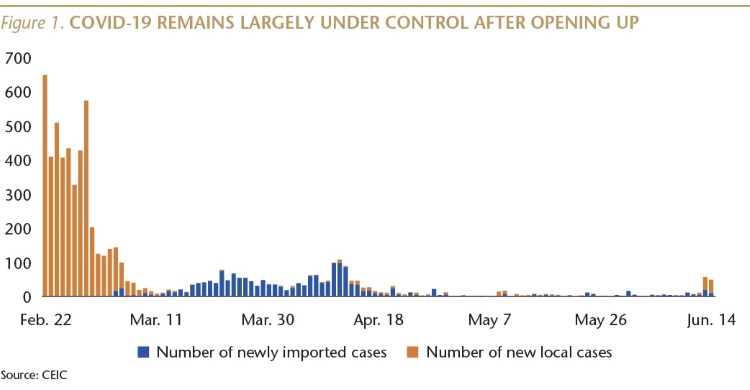

When thinking about prospects for the Chinese economy, one of the most important factors is whether the coronavirus remains under control. At this point, China appears to have largely wrestled COVID-19 into submission, but a new outbreak in Beijing provides a cautionary tale for all nations, suggesting that eradicating the virus will be extremely difficult.

On June 14, only 177 coronavirus patients were in hospital, down from the February 17 peak of 58,016. The recovery rate for hospitalized patients is now 94% across China, up from 17% on February 17.

China began gradually lifting social distancing and other restrictions for areas outside of Hubei Province (where Wuhan is the capital city, and where the virus was first identified) on February 9. During the 14 days prior to that date, in China (excluding Hubei province), the average daily number of new COVID-19 cases was 657, and the average daily number of deaths was two. In contrast, during the 14 days ending June 14, in China ex-Hubei, there was an average of 12 new daily cases and no deaths due to COVID-19.

The social distancing restrictions began to be lifted in Wuhan on April 8. During the 14 days prior to that date, there were a total of only two new COVID-19 cases, and the average daily number of deaths was three. During the 14 days ending June 14, there were no new cases or deaths due to COVID-19 in Wuhan.

(During the 14 days ending June 14, there was an average of 22,151 new daily cases and 816 daily deaths in the U.S., and an average of 1,509 new daily cases and 197 daily deaths in the U.K.)

It was also encouraging that six weeks after a five-day national holiday in China, when over 100 million people traveled for leisure, there had not been a spike in COVID-19 cases. But that picture changed over the weekend, when there were a total of 72 new local cases in Beijing within two days. This is not a huge number, in the context of 395 new cases in New York City on June 14, as well as 302 in Dallas and 995 in Los Angeles on that one day. For Beijing, however, which prior to the weekend had gone almost two months without a new case, this is a worrying sign. The government responded with widespread testing and contact tracing, some schools near the outbreak were closed, and a few local officials were sacked.

As in other countries, the potential for a rebound in coronavirus cases is the biggest risk to a post-lockdown economic recovery in China. At the moment, however, a combination of testing, contact tracing and social distancing, as well as strict quarantine of all international arrivals seems to be keeping the virus largely at bay.

And, when thinking about the veracity of coronavirus data, it is worth noting that the rate of COVID-19 deaths per 100,000 population in China (0.3) is similar to that of some other countries in the region: Singapore (0.4), South Korea (0.5), and Japan (0.7).

A nascent V-shaped recovery

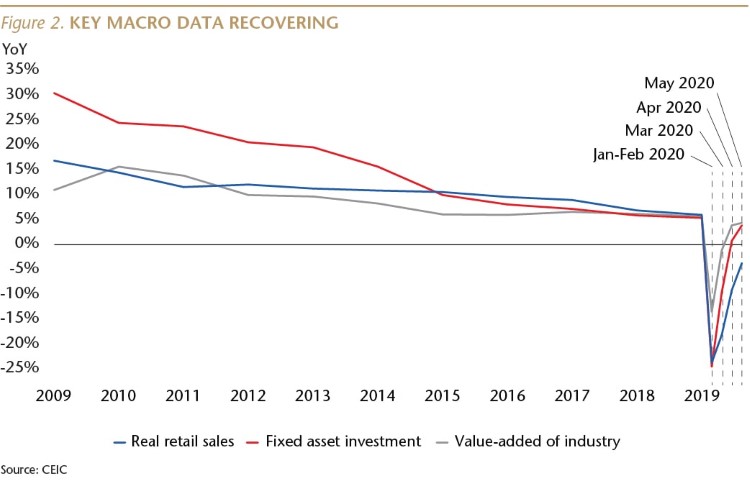

As we wrote in the April 17 Sinology, China's first quarter economic data was dismal. Real (inflation-adjusted) retail sales, for example, declined 21.8% YoY, industrial value-added fell 8.4% YoY, and fixed asset investment was down 16.1% YoY.

We also wrote that those dismal numbers were the result of a virus that shuttered most shops, factories, offices and restaurants, and did not reflect structurally weak supply or demand, or a financial system crisis.

Now that the virus has been largely brought under control in China, those businesses have gradually been opening, and life is starting to return to normal, as are many key economic indicators.

China is a domestic-demand driven economy, so the recovery in consumer spending is critical. Last year was the eighth consecutive year in which the consumer and services (tertiary) part of China's GDP was the largest, and consumption accounted for almost 60% of GDP growth.

Real retail sales growth plummeted to -23.7% YoY in January/February, but bounced to be only down 9.1% in April and then down 3.7% in May. A good recovery, but not yet back to normal: in May 2019, real retail sales rose 6.4% YoY.

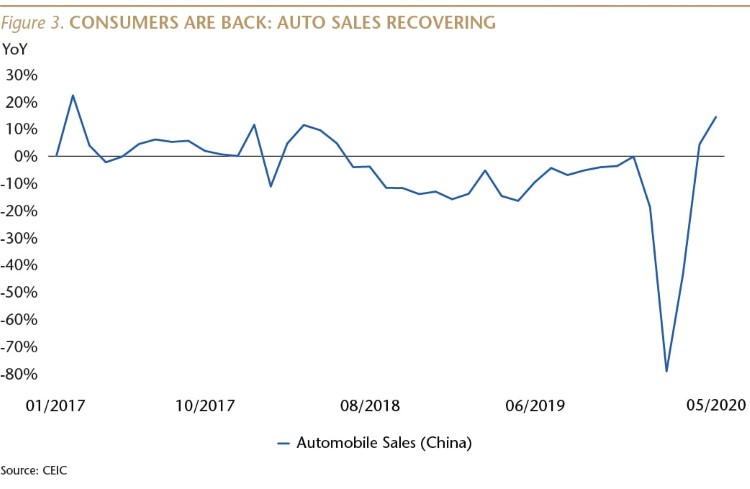

Auto sales were down 79.1% YoY in February, but began to recover strongly in April, when sales were up 4.4% YoY. In May, auto sales rose 14.5% YoY, in sharp contrast not only to February's low, but also to the 16.4% YoY decline in May 2019. Last month was the first month of double-digit YoY auto sales growth since April 2018.

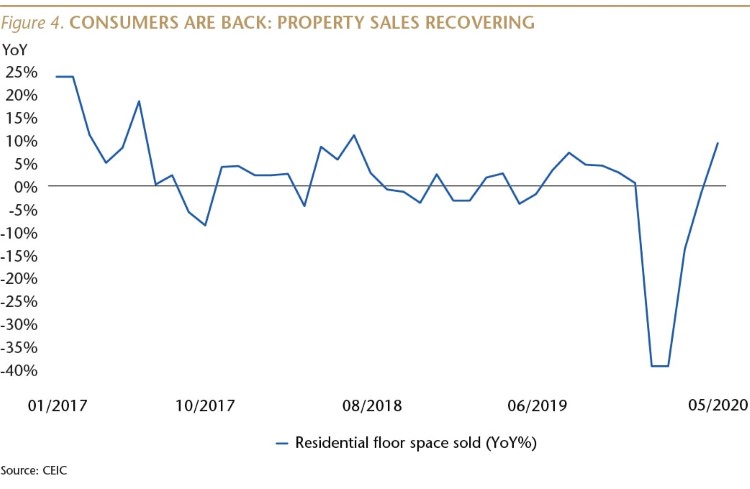

Residential property sales also recovered strongly. After being down 39.2% YoY (in square meter terms) in January/February, sales were only down 1.5% in April, before rising 9.3% YoY in May. (In May 2019, property sales fell 3.9% YoY.)

The recovery of sales of autos and homes reflects that middle-class and wealthy consumers have both sufficient money and enough confidence in the future to spend it. And it wasn't only big-ticket items that bounced back last month.

Sales at food services and drinking places rose 31% month-on-month in May after a 26% MoM increase in April. Restaurant and bar sales were still down 18.9% YoY last month, due in large part to lingering fears many people have about gathering indoors, but the sector is beginning to recover.

Online sales of goods rose 22% YoY in May, up from 16.2% in April and 10.7% in March, and faster than the 19.9% YoY pace a year ago. During the first five months of the year, online sales accounted for one-quarter of total retail sales.

CapEx recovering

Corporate confidence also continued to improve last month, including by privately owned companies, whose CapEx spending declined by only 0.1% YoY following a decline of 2.6% YoY in April and a 26.4% fall in January/February.

Not yet back to normal (private firm CapEx rose 4.8% YoY a year ago), but heading in the right direction.

Last month, investment in infrastructure rose 8.3% YoY, up from 2.3% in April and a decline of 30.3% during the first two months of the year. This was the fastest monthly growth rate in two years, and, along with new fuel efficiency requirements, helped drive a 76.6% YoY increase in excavator sales in May.

Recovery without a stimulus bazooka

It is worth noting that this healthy economic recovery has come without a dramatic stimulus. Credit growth, for example, has only accelerated modestly. Augmented Total Social Finance (TSF) outstanding, the broadest metric for credit growth, was up 12.7% YoY by the end of May, compared to an 11.3% growth rate during the same period in 2019. Far from the 26.9% growth rate during the same period in 2009, when Beijing implemented a massive stimulus in response to the Global Financial Crisis. This highlights the strength of an organic recovery, and leaves the government with plenty of dry powder if the recovery were to falter.

Unemployment remains a concern, but the absence of social unrest and the rebound in consumer spending suggests that the government's support for workers and businesses has provided a cushion for many who lost their jobs, laying the foundation for an economic recovery.

China is not export-led

Finally, I would like to remind readers that because China is a domestic-demand driven economy, there is a low risk that a possible COVID-driven global recession, or the on-going downward spiral in U.S.-China relations might derail the recovery. Last year, domestic consumption accounted for almost 60% of GDP growth. The gross value of exports was equal to 17% of China's GDP (down from 35% in 2007), but almost 30% of those exports were processed goods for which little value was added in China. Significantly, over the last five years, net exports (the value of a country's exports minus its imports) have, on average, contributed zero to China's GDP growth. Moreover, only 17% of China's exports went to the U.S. last year. So while a collapse in demand for Chinese exports would be a drag on the recovery, it would likely be a modest drag.

Andy Rothman

Investment Strategist

Matthews Asia