The Sun is Rising

Portfolio manager Shuntaro Takeuchi says Japanese equities, for so long a market of false dawns, may now be stirring up investment opportunities that finally present Japan as a long-term growth market.

Takeaways:

- Japanese equities have generated attractive performance year-to-date, largely due to earnings-per-share (EPS) growth on the back of profit-margin improvements and better corporate governance.

- We believe this is only the start of a powerful corporate earnings growth story given the financial health of Japanese corporates.

- Three categories of “quality companies’, responsive to different points in the investment cycle, can offer investors exposure to potential corporate profit growth.

What is driving Japan equity returns? Year to date, the MSCI Japan Index has returned nearly 15% and at the time of writing this article, the Nikkei 225 hit its highest level since New Year’s Eve, 1989.1 Since its peak 33 years ago, investors have endured an economy that has struggled in the aftermath of an historic price bubble and rooted stagflation. Today, some market commentators say this rally of 2023 may just be the start of a new era for Japanese equities. I would argue that this ‘new era’ emerged a decade ago.

Before the global financial crisis in 2009, Japan was a classic cyclical market which would lose money during every downturn. In the last decade, however, the dynamic has meaningfully changed. It’s been a story of consistent margin and corporate governance improvements unfolding. And more recently we have seen a further acceleration of shareholder return as a result of steady increases in stock buybacks and dividends over the years. Consequently, investors, among them Warren Buffett, are once again taking notice and inflows into Japanese equities have been positive year-to-date.2

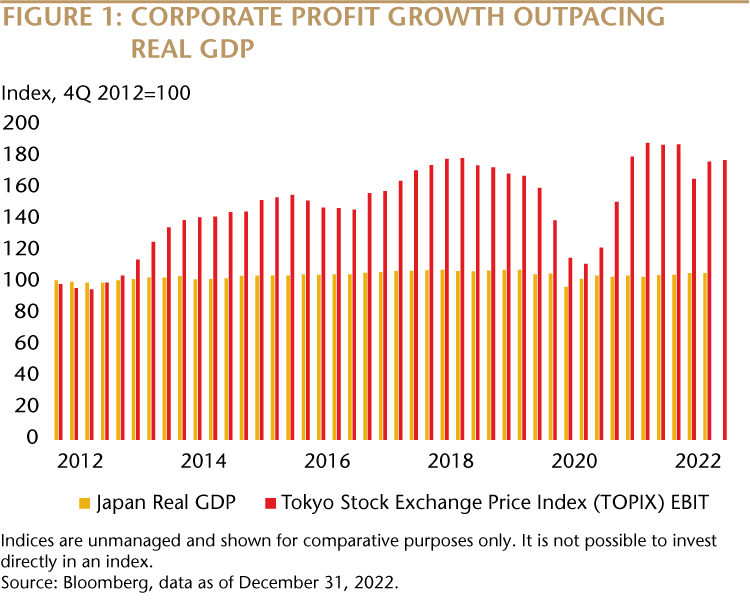

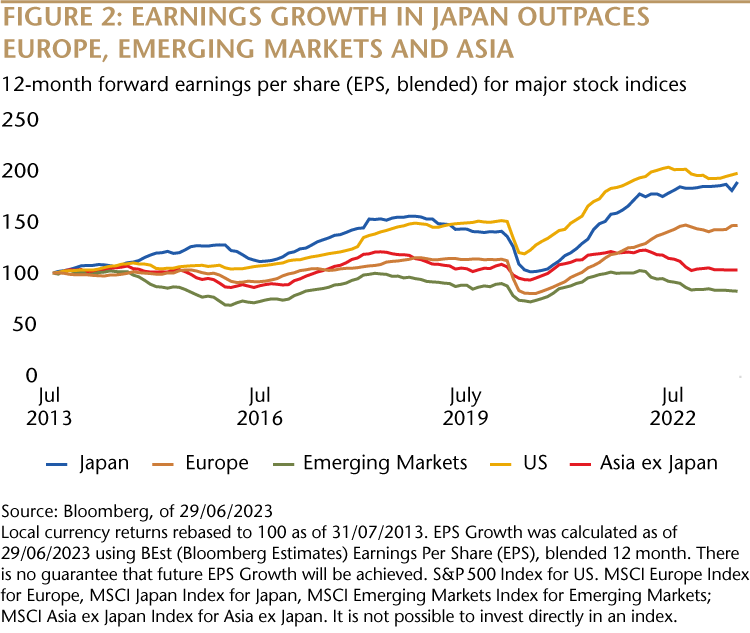

More profits at the margin

Japan has long been considered a so-called ‘value, mean reversion market’—meaning that after an extreme price move, asset prices tend to return to average levels—with global investors typically trading in and out few times during each decade. This made sense in the 1990s and 2000s when Japan corporate profits were exposed to huge swings in cyclicality and low-margin profiles pushed companies down to loss making levels during the downturns. Over the past decade, however, Japan’s equity market has evolved with asset prices improving steadily on their long-term norms. During this period, EPS growth on a compounded basis was higher than some key international markets, and even kept pace with the S&P 500-despite anaemic growth in Japan’s underlying economy (see chart 1 and 2).

The reasons for this positive progress lie with improvements in profitability based on raising prices, cutting cost and divestment from non-core businesses, and more efficient capital allocation triggered by policies and reforms. A recent meaningful initiative is the Tokyo Stock Exchange’s move to direct some listed companies trading below their book value to work at increasing their stock prices, for example, by paying higher dividends and buying back stock.

Overall, we believe this trend of higher EPS growth will continue to unfold over the coming decade. Japanese companies are generally in good financial health due to better cashflow generation and years of cash hoarding. More than half of listed corporates have no net debt on their balance sheets.3 It leads us to believe that recent improvements in shareholder returns on top of a record amount of share buybacks are only the beginning of this powerful structural earnings growth story in Japan.4 The country also has some macro and external tailwinds. Its economy, with low interest rates, only moderate inflation and a weak yen, is supportive of equity prices, and Japan could also benefit from changes in supply chains as some companies seek less dependence on China. That all said, we believe Japan’s growth story is one that can be sustained for some time irrespective of the wider environment.

How to get the best out of Japan

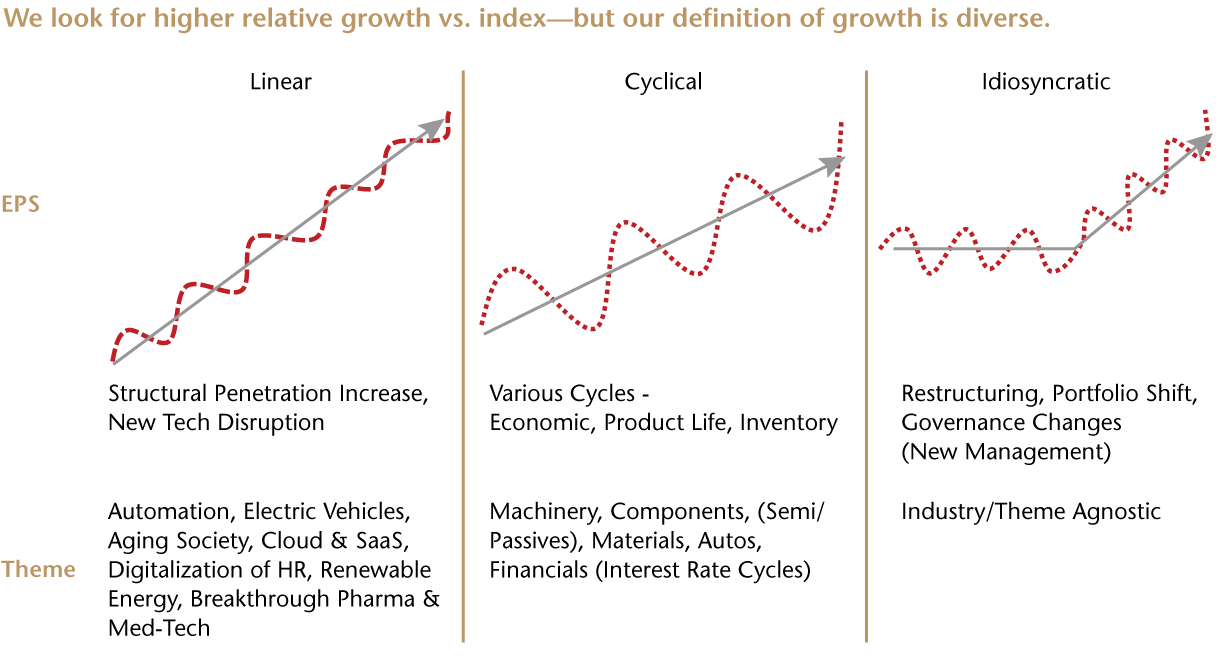

As quality growth investors, we are excited by the current opportunities on offer within the Japanese equity market. We focus on investing in Japanese companies with differentiated business models, sustainable competitive edges, attractive growth prospects and capable management teams. We believe companies with these profiles provide a strong track record of delivering growth with a strong positively upward-sloping margin profile. We break down our exposure to quality growth in three categories.

The first is “cyclical growth” companies - namely those associated with semiconductors, automation and even auto components – achieving higher lows due to structural margin enhancements. Japanese corporate profits are still export-sector dominant and not immune to global manufacturing cycles, but some corporates have succeeded in consistently achieving better profitability during downturns. While timing the bottom of the cycle is often less predictable, we seek for opportunities to invest during the downcycle.

Second is the “linear growth” category. Despite Japan’s declining and ageing population, we see many domestic growth opportunities that steadily achieve constant earnings growth. To counter the decline in labor production and stay ahead of flat growth you need productivity growth and Japan is home to many companies that provide relevant solutions - like software, health care and IT services. They have played a considerable role in driving profit growth to the market overall. Due to its high predictability in earnings growth trajectory, this category tends to trade at a premium valuation. While we need to be mindful of the level of premium, the category shines when earnings growth deteriorates broadly.

The third category is “idiosyncratic growth” which is theme and industry agnostic, and the growth come from self-help. One example would be old legacy conglomerates - such as Hitachi and Sony – focusing on return on invested capital (ROIC) improvements and de-consolidating asset heavy businesses to become more efficient and improve their earnings as well as total shareholder returns.

We believe by investing in these three different categories of growth companies, we aim to provide investors with the full spectrum of the structural growth opportunities of Japanese corporate profits, responsive to different points in the investment cycle.

Shuntaro Takeuchi

Portfolio Manager

Matthews Asia

1Data as of 15 June 2023, in USD. All performance quoted represents past performance and is not indicative of future performance. Indices are unmanaged and shown for comparative purposes only. It is not possible to invest directly in an index. Source: Bloomberg

2Data as of 15th June 2023

3Source: Bloomberg, data as of 15th June 2023

4https://www.japantimes.co.jp/news/2023/06/11/business/corporate-business/japan-stock-buybacks/

Index Definitions:

MSCI Japan Index

The MSCI Japan Index is a free float–adjusted market capitalization–weighted index of Japanese equities listed in Japan.It is not possible to invest in an Index.

MSCI All Country Asia ex Japan Index

The MSCI All Country Asia ex Japan Index is a free float–adjusted market capitalization–weighted index of the stock of markets of China, Hong Kong, India, Indonesia, Malaysia, Philippines, Singapore, South Korea, Taiwan and Thailand.

MSCI Emerging Markets Index

Captures large and mid-cap representation across 24 Emerging Markets (EM) countries. With 1,138 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. EM countries include: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

MSCI Europe Index

The MSCI Europe Index captures large and mid cap representation across 15 Developed Markets (DM) countries in Europe*. With 423 constituents, the index covers approximately 85% of the free float-adjusted market capitalization across the European Developed Markets equity universe.

The S&P 500 Index

The S&P 500 Index, or the Standard & Poor's 500, is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ.

The Nikkei 225 Index

The Nikkei 225 is a major stock market index that lists the 225 largest companies by price weighting on the Tokyo Stock Exchange.

As of 5/31/2023, accounts managed by Matthews Asia held positions in Sony and Hitachi. This information is presented solely for illustrative purposes and is not representative of the results of any particular security or product.