Engines of EM Growth

Portfolio Manager John Paul Lech explains why investors in emerging markets should go upstream in order to leverage the long-term power of the EV sector.

Electric vehicles (EV) are a big investment theme and emerging markets serve a critical function as both end destinations for the cars themselves and as the location for many companies involved in their manufacture.

There are plenty of companies involved in the production of EVs and many have viable offerings and ambitious roadmaps. The excitement in the space is merited—the potential is huge and the prospects of reducing tailpipe emissions are real. However, while EVs are a rapidly growing consumer discretionary market—thanks to their perceived environmental and social attributes—it’s a fiercely competitive industry with tight margins and still evolving products.

To better understand the EV market—and the potential of all its players—it’s helpful to understand the drivers that have propelled the industry to where it is today. One of the biggest forces has been regulatory incentives. Regulation can bring positive inducements and negative costs, both of which shift consumer behavior. I grew up in Denver, a city which regularly exceeded the Environmental Protection Agency’s (EPA) air quality standards in the early 1980s. My dad also worked for the EPA. While the agency has regulated emission standards since the early 1970s, I have seen how the regulatory topography in the U.S. and in other markets has shifted its focus to climate inducements for the mass adoption of EVs.

The recent Inflation Reduction Act (IRA), for example, provides major incentives for EV adoption, and California, the largest U.S. state and car market, has announced its intention to halt sales of new gas cars by 2035. The state has also given preferred access to high occupancy vehicle (HOV) lanes for autos that meet certain emission criteria, while in China purchasers of EVs often get to skip the waiting period for license plates. Favorable regulations and inducements have been highly effective in incentivizing EV manufacturing and encouraging consumer adoption.

Who’s in the driving seat?

A second driver for the growth of the EV industry has been technology. EV models now rival and often surpass internal combustion engine (ICE) models in terms of consumer experience. Charging availability, times and range have all vastly improved. Performance is also incredible. It’s been over five years since Tesla’s Model S overtook Porsche’s 911 in 0-60 mph acceleration and it’s not hard to find reports that extol the benefits of EVs in terms of maintenance, braking and safety. Most manufacturers are now well advanced in their plans for rolling out electric fleets, notably in the SUV and truck segments, which in the U.S. represent the majority of sales.

However, EVs, contrary to general public perception, aren’t a new invention. They’ve been around for more than a century. In fact, EVs represented a greater percentage of vehicles sold in the years before the arrival of the Ford Model T than they do today. At the turn of the 20th century there were many EV manufacturers—including Ferdinand Porsche who developed an electric car in 1898. With the arrival of the Model T, the ICE platform proved itself to be the most viable mass market route for the technology at the time. It’s taken another century of innovation to help ignite consumer adoption of EVs.

So the EV revolution, evolution, renaissance, call it what you will, has been driven by regulation and technology, not by sustainability-linked investment flows. Investor behavior is often cited as an impetus for change but in reality it’s mostly availability, pricing, performance and—importantly— regulation.

The road ahead

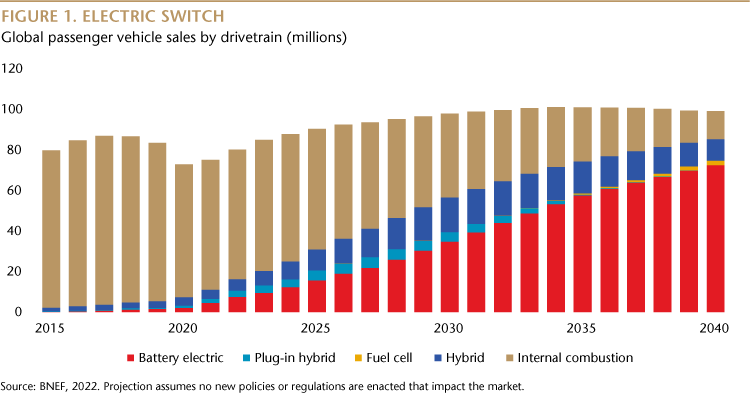

When it comes to life-changing new products, investment themes often follow the same pattern of disbelief, curiosity, hype and then deflation when it becomes evident that the story is more complicated. In the case of EVs, mass consumer adoption won’t mean a step change in total market volume. While EVs are poised to take a big share of total cars sold, they are expected to largely replace sales of ICE vehicles.

What’s more, the next few years will likely bring a more complex competitive environment and substantially lower levels of aggregate profitability for the auto industry. EV margins are rarely on a par with ICE margins and in this environment, car makers—some of whom will be new to the industry—will be striving to build superior products to win over consumers. The auto industry is littered with innovative companies that didn’t make it. When I was young, my grandmother gave me a model of a Duesenberg, which was a high-performance racing and luxury car company founded in 1920. Duesenberg grew quickly and eventually had a powerful and beautiful model that came out right before the Great Depression. Consumer budgets tightened and preferences changed. The innovative products of Duesenberg, along with those of Studebaker, Tucker, and DeLorean, didn’t translate into lasting commercial success.

Turning to EV consumer markets, China dominates and given the scale of its economy that’s a good thing. However, most manufacturers tend to target the same narrow, high-end segment. The strategy is often to try and dominate the luxury market first, then foreclose on competition and then expand into more modest offerings making good margins in the process. It’s a similar playbook for the U.S. The average price of an EV is over US$60,000, limiting the buyer pool until a more affordable product range comes to market.

Look upstream

In contrast to the market dynamics faced by EV makers, many of the elements and components that go into EV manufacturing operate in more stable competitive environments where there is potentially higher pricing power.

A large focus of EV manufacturing is centered on the batteries which are complex to produce. While there are many car companies there are only about four or five companies that dominate the battery space and most of these are located in China and South Korea. Availability is the first thing that matters with new technology. Only after something is reliably available do other factors like price, performance, features and convenience really start to enter the fray. Without battery companies, mass EV adoption simply cannot take place.

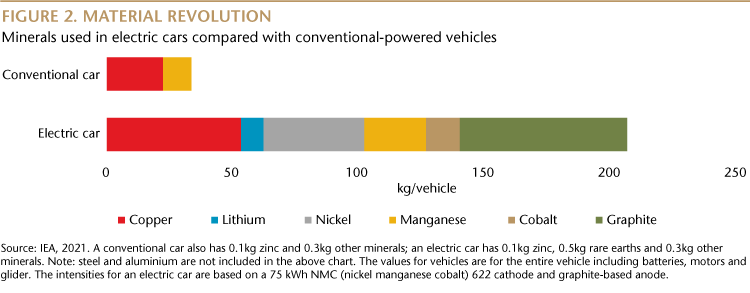

While EVs are not revolutionary in that they still transport you from A to B they are revolutionary in their usage of the materials required to power them. Roughly two-thirds of the cost of an auto battery comes from the raw materials used to produce it. The physical reality of EV adoption is that more and more diverse stuff has to get pulled out of the ground. An electric car takes roughly two times the copper and manganese of an ICE car. Nickel is also a key component of batteries—on average an EV consumes roughly 40 kg but the metal is barely used in ICE cars. Base metals are needed for the associated charging infrastructure as well.

The upstream implication of shifting from ICE to EV models is a massive shift from liquids to metals. Electrification writ large will require huge investments in base metals which many investors have little conception of. These are unique and meaningful assets that are often underrepresented in investor portfolios and tied to the notion that these industries are intrinsically bad. But it’s impossible to be a true proponent of any industry without an investment framework that supports that industry’s basic building blocks.

The EV industry’s building blocks, we believe, are set to benefit from the mass adoption of electric autos and have the potential to generate better risk-adjusted returns. Many of these kinds of companies are spread through emerging markets, in Africa, Latin America and Southeast Asia.

Finally, most of us will be familiar with the ongoing semiconductor supply chain constraints in the auto industry. Semiconductor content in autos can increase even if total vehicle unit growth is low because content per vehicle continues to rise. Density has surged not only because of vehicle electrification but also due to developments in advanced driver assistance systems (ADAS), infotainment and safety features. The growth of the EV industry provides investment opportunities in both semiconductor production equipment (SPE) and the fabrication space.

The competitive topography of these sub-industries is much more concentrated than in vehicle manufacturing and we believe that the ability to generate both strong margins as well as returns on capital invested is likely superior to that of the auto space.

Fully-charged returns

Looking ahead over the next 10 years, there will be great EV offerings in pretty much every segment. Some EV companies will make it but like Duesenberg a century ago, there will be many who don’t. While some legacy brands will transition well, others will likely stop being relevant. We also think that at least one and probably a handful of pureplay EV manufacturers will cement themselves as a true global player or at least a highly relevant regional one.

Investing in potential winners in the EV space is hard but the emerging markets sandbox is blessed with many upstream businesses ranging from materials to industrials to the semiconductor-value chain. In our opinion, many of these opportunities have better market structures which are likely to produce more sustainable returns over time. So go buy an EV, I intend to, but for my equity exposure I plan to look upstream.

John Paul Lech

Portfolio Manager

Matthews Asia