How to Invest in China Responsibly

Investors in China can positively influence the behavior of Chinese companies and generate attractive risk-adjusted returns in the long run.

"China has made big inroads on a number of sustainable issues, including state ownership, shareholder friendliness, control structures, disclosure and environmental stewardship."

There are strong long-term reasons for investors to allocate to China, be it for asset or theme exposure, diversification needs, or alpha generation. For many investors, however, the bigger issue is whether having exposure to China can be done in keeping with a commitment to being a responsible steward of capital. There’s perhaps no other market where Environmental, Social and Governance (ESG) issues, not to mention geo-political concerns, are more top of mind. In this roundtable discussion, Matthews Asia Chief Investment Officer Robert Horrocks, PhD, Head of ESG Kathlyn Collins and Portfolio Manager Andrew Mattock explain how investors can align their investment principles with the opportunities that China has to offer.

The China Dilemma

By Robert Horrocks, PhD - Chief Investment Officer

The first thing to bear in mind is that China’s evolution into a major industrial and economic power has played out over decades rather than the centuries it has taken for Europe and the U.S. to establish themselves as global leaders. That means China is still busy addressing pollution, workers’ rights, shareholder transparency, and all the other things intrinsically tied to the expansion of a modern industrialized economy. The good news is that China is making a lot of progress on these issues.

Secondly, the Chinese culture is built on the values of the community and not the individual. It’s different to the West. There’s no way you can really get around that. But I would argue there’s no need to. In fact, it can work in the interests of sustainable investors. If you’re interested in investing in companies that promote diversity, facilitate access to health care, housing and education, and make the environment cleaner, then you’ve come to the right place. These are areas the Chinese government is focused on and encouraging growth in.

China and the environment

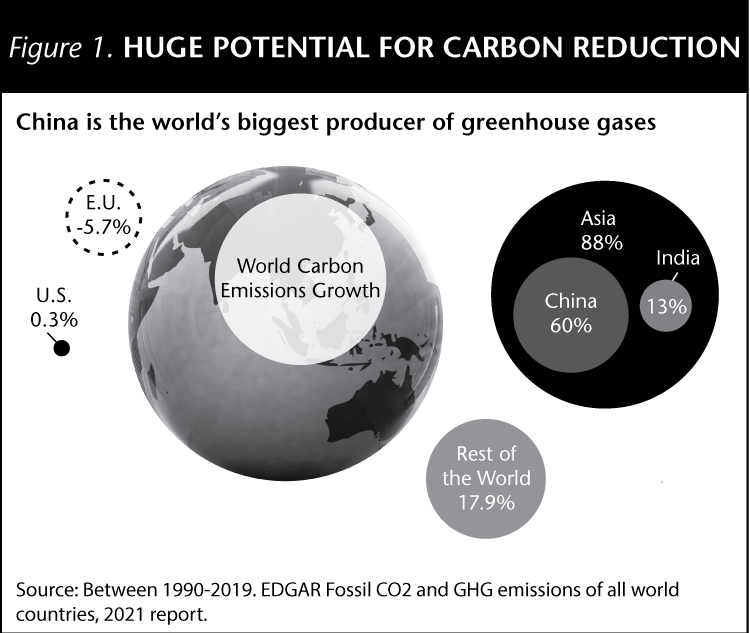

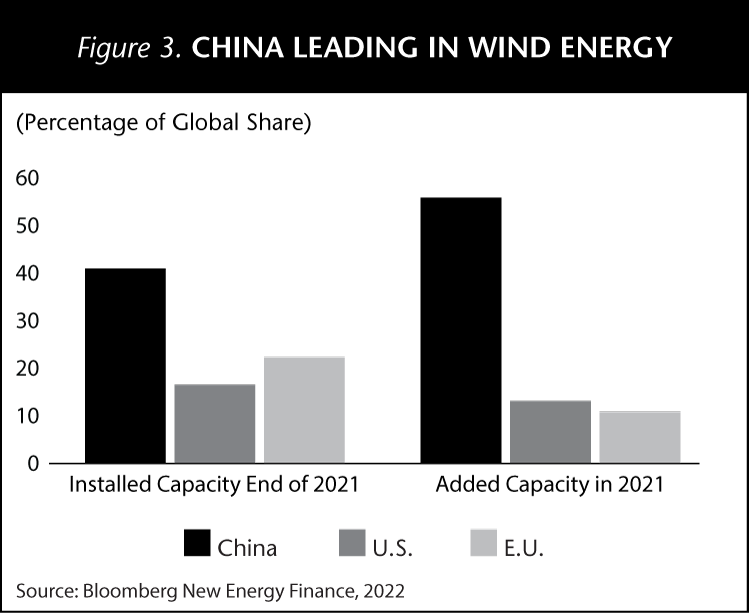

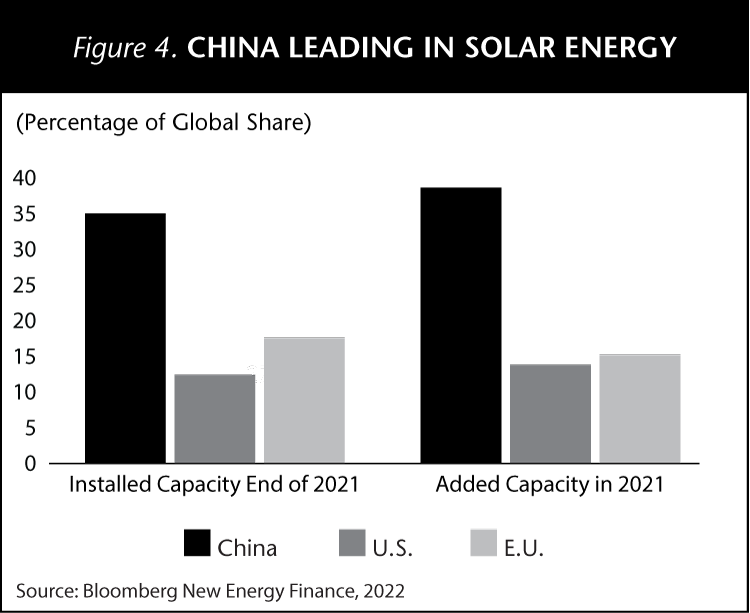

China has some significant climate-related commitments. Among them, it’s pledged to be carbon neutral by 2060 and for its CO2 emissions to peak before 2030. It has a target for 40% of new vehicle sales to be New Energy Vehicles (NEV) by 2030 and in solar and wind China has pledged to have 1,200 gigawatts (GW) installed capacity by 2030. To put the latter in perspective, by the end of 2021 global renewable generation capacity amounted to 3,064 GW.

As we all know, goals are one thing, delivering on them is another and China has a way to go to achieve its goals. Earlier this year it moved to boost domestic coal mining capacity as a way of exerting more control of pricing in the fuel. The war in Ukraine and the disruption it has caused in energy supply chains is also pressuring China, and indeed many other major energy users, to prioritize securing their traditional energy supply rather than aggressively moving to more sustainable options. But China does need to reform its energy mix and improve energy efficiency for industrial companies.

Standing back a little, it’s not an easy task to decarbonize an economy that has become the workshop of the world, producing everything from iPhones and cars to wind farms and batteries. But two things are providing tailwinds on China’s road to environmental transformation. Firstly, the ability of the Chinese government to instruct and incentivize industries to switch focus into new areas of production. Secondly, and perhaps more importantly, China’s own citizens have demanded the government address emissions and improve air quality.

China and social issues

Workers’ rights and workplace safety have been under the spotlight in China for some time. Again, this goes back to the development of China as an economic power. In the late 1960s, 90% of Chinese people lived in poverty, now it’s around 10%. While it’s true that worker benefits are not at the level accessible by many in the U.S. and Europe, the welfare of China’s workers has come along in leaps and bounds in recent decades. Overall, they are at a better place than they have ever been and the government is increasingly trying to put the modern trappings of middle-class life their way.

China’s treatment of ethnic populations, like Uighurs, is another source of international concern. It’s a serious matter but we believe it’s a political issue rather than a labor issue. It doesn’t pervade the workforce. That said, at Matthews Asia we consider our responsible investment strategy in all our portfolio decisions. We recognize that the treatment of ethnic minorities in China and the potential use of forced labor are issues of concern to our clients. We do our research, engage with companies and ask questions of them and if we aren’t satisfied with the answers they give, we don’t invest.

China and governance

China’s government has shown itself to be a pretty good steward of people’s money. It has overseen a huge anti-corruption drive and made inroads improving corporate governance, business-owner accountability and shareholder transparency. Still, for better or for worse, China doesn’t tend to do things by halves. Over the last decade, it encouraged stock-market expansion on a huge scale and one unintended consequence was that a lot of companies that came to market had poor corporate governance and in some cases were not fit for purpose. China is now trying to put an onus on financial institutions to behave like mature, seasoned, investment cultures. It’s a tough ask. This is why active management that uses fundamental research to distinguish between companies that create value for shareholders from those that destroy shareholder value is imperative.

Inseparable from China’s support for industries and markets is its need to regulate them. In the past 18 months or so, we have seen intervention in finance, real estate, e-commerce and gaming. The motivation behind these moves has been to eradicate anti-trust issues, protect data privacy and diffuse speculative bubbles. Unfortunately, communication on these interventions is often not well executed and the detail of the regulation has been lacking. It’s resulted in Western misinterpretation of rules, market volatility and perfectly sound companies enduring selloffs while their fundamentals remain unchanged. When we look at the sustainable investing landscape in China over the next three to five years, the main change we expect is China will be doing a better job of telegraphing and explaining new rules.

China and geopolitics

Geopolitics is never far away when it comes to China. Just think back to the trade wars between China and the Trump administration. Since the beginning of the war in Ukraine, relations between the West and China are being tested once again. Like Europe, China is dependent on Russian oil while Xi Jinping and Vladimir Putin have nurtured a bond in their struggles with the West. Concerns over potential U.S. sanctions on China in response to any support China is seen to be giving to Russia have come to the fore. So China is in a tricky situation. As the war continues, it needs to ensure its partnerships with Europe don’t breakdown and that its relations with the U.S. don’t go into freefall. Right now, China and the U.S. are in potentially promising discussions about resolving an auditing dispute that would avoid a possible delisting of Chinese stocks listed in the U.S.

Geopolitics is hard to predict. Our view has always been that engaging with China, as has been proven for the past 40 years or so, significantly advances a wide range of U.S. interests. The best way to influence China’s behavior is to engage with it socially, economically and politically. As investors, we are investing in companies rather than a country or a political party. And while China remains socialist in its political structure, it has overwhelmingly embraced a capitalist economic system that continues to offer compelling bottom-up investment opportunities.

Putting it all together

In summary, it’s hard to see any other emerging market offering a better investment opportunity than China in terms of the potential emergence and growth of responsibly managed companies and the ability of investors to help bring change regarding social, governance and environmental issues. The improvements that investors can help drive in China are significant and these are also improvements that the Chinese government wants itself. It’s not a fight. What’s more, investing in China can help influence the behavior of the country’s corporates that will not only have an impact on China’s economy but potentially on the world economy.

Safeguarding My Investment Principles

By Kathlyn Collins - Head of ESG

Aside from the philosophical and economic arguments for sustainable investing in China it’s equally important to know what tools and strategies there are that investors can deploy to safeguard their investing principles.

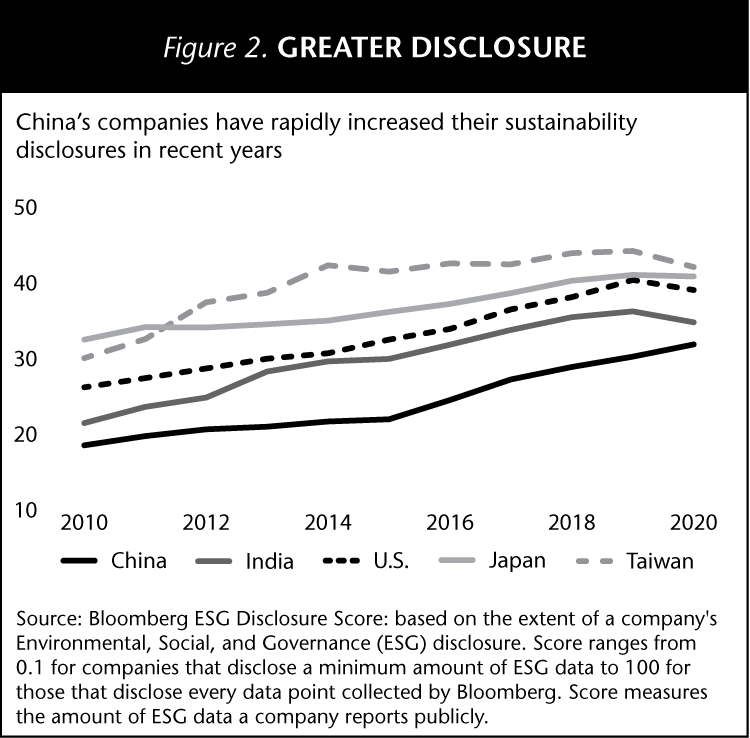

In just the last five years, China has made big inroads on a number of sustainable issues, including state ownership, shareholder friendliness, control structures, disclosure, board composition and environmental stewardship. On the ground, the changes in and toward Chinese companies are striking. Overseas ownership in mainland China equities has increased and in the mainland A-Shares market the proportion of companies that have large shareholders with more than 30% holdings is in decline. That’s enabling greater access to investment opportunities for smaller investors and companies becoming accountable to a broader shareholder base.

Secondly, the reform of state-owned enterprises (SOEs) has cut down subsidization and artificial pricing. SOEs are getting more efficient and more responsive to market changes. That’s improving governance and accountability.

The area of corporate governance that has perhaps seen the biggest improvement concerns transparency. The stock exchange reforms have gone a long way to cleaning up business practices and deepening equity research. With more information, comes more accountability; transparency goes up, governance goes up and investor participation goes up.

Sustainable safeguards

Sustainable safeguards should be stitched into any investment strategy for China. For example, at Matthews Asia, we are mindful of governance, environmental and societal issues across all our strategies and that includes China. We take both a top-down and bottom-up approach and use proprietary and third-party research, and screening strategies.

And a lot of our integrated ESG approach is focused on governance at the company level. We look very closely at ownership structures, management incentives and whether companies have affiliated businesses. We also take account of third-party views. If we have concerns about a company and have enough conviction in it, we will engage with the company to try and get answers.

Our focus on governance and growth can naturally lead to companies that are innovating to mitigate a negative impact on the environment. These companies also often tend to be in synch with what the government’s priorities are and so, to a degree, are less exposed to top-down surprises such as regulatory intervention.

We also examine workplace culture and consumer protection, like the use of data and data privacy. Tied to this, we look at how companies are positioned in regulatory environments and how exposed or adaptable they may be to new rules.

Third-party ratings and research are important but we believe that regional and locally produced reports are more in step with the issues that matter to mainland Chinese companies than Western ESG monitoring platforms tend to be. In our experience, local and proprietary research are the best sources of understanding regarding local rules and issues of importance.

Responsible engagement

Active management and engagement is a crucial element of sustainable investing. We reach out to companies in China to influence and change corporate sustainability behavior. Engaging with businesses is usually most effective with small and mid-cap companies. These companies often are not advanced in terms of their external institutional investment communications and strategy and that is where we can engage with them and create positive change.

That said, engagement in China has become much easier over the last few years. In April, the China Securities Regulatory Commission (CSRC) instructed Investor Relations (IR) professionals to proactively engage with shareholders on ESG matters. Given that China doesn’t have a Stewardship Code this was significant. The main thrusts of the new guidance were for IR teams to focus on treating shareholders fairly, including minorities, to be proactive and engage with investors, and that management pay attention to the function of IR and recognize its value. In IR discussions with shareholders, the regulator is also encouraging companies to include ESG information, cultural contributions and how shareholders can use their voting rights. It’s a continued step in the right direction and a far cry from a time when Chinese companies only communicated with exchanges and not markets.

Responsible Investment Opportunities

By Andrew Mattock - Portfolio Manager

To identify responsible investment opportunities in China it’s better to try to discern what the Chinese people want from their government rather than what the international community wants from China. Environmental issues are bigger in China than anywhere else in the world. People want to be able to breathe clean air and the government has had to be responsive to that. So China is making seismic moves to adjust an economy that was effectively built on a pollutive platform.

Responsible investment opportunities exist in the older industries that are changing as well as newer alternative sectors. Companies in staple industries, like cement making, are applying technology to make their businesses less environmentally harmful. And then there are the industries where green alternatives exist—hence the push into renewable energies, battery cars, electrification and infrastructures.

In a government-led country like China it makes sense to align your investments with the direction the government is moving in. China’s new five-year plan, called ‘Common Prosperity’, brings a lot of sustainable investing issues into government policy. The plan’s basic tenet is to give China’s citizens equitable access to education, health care and housing in an effort to encourage a more even distribution of wealth.

Embracing responsible investment strategies

What that means in practice is that if you find opportunities to invest in companies addressing aspects of social housing, the environment, infrastructure, health care and vocational education, these are also growth areas supported by the government. Take the environmental-related stocks, China is already the largest and fastest growing market for electric vehicles (EVs).

A responsible China strategy could consider a wide range of holdings across sectors, old and new. It would include holdings with both strong governance features and attractive growth and valuation characteristics. The portfolio could span stocks in older sectors like materials and industrials; brokers and banks that meet China’s financial inclusion targets; health-care stocks like medical device manufacturers; technology and IT stocks; and alternative energy holdings like waste recycling companies and battery makers.

There are good reasons to invest responsibly in China. By being attentive to corporate governance, growth opportunities and government policy, investors can not only invest responsibly in China, they also have the potential to positively influence the behavior of Chinese companies and generate attractive risk-adjusted returns in the long run.

Definitions:

Alpha: Describes an investment strategy's ability to beat the market. It measures the performance of an investment against a market index or benchmark that is representative of the overall market’s movements.