Opportunities With Impact

In the complex landscape of ESG/sustainability strategies, Vivek Tanneeru, Portfolio Manager, explains why investors should focus on sustainable investing approaches that go beyond ESG integration and aim to deliver meaningful contributions to society and the environment.

Environmental, social and governance (ESG) funds have attracted significant fund flows in the past few years fueled by shifting investor preferences that increasingly include factors such as climate impact, diversity and inclusion and corporate governance to fully account for investment risks and opportunities. But the explosion in popularity of ESG funds has generated an avalanche of product launches, information and jargon that makes it difficult for investors to understand whether funds are meeting their social and environmental needs or just paying homage to the trend. We’d like to cut through this noise and explain the approach we believe offers a means to invest in quality companies that are contributing to positive outcomes.

Traditionally, equity-based investments have been assessed on two dimensions: risk and return. As the world has become more connected and the impact of our actions on society and the environment more visible, this two-pronged approach for many investors is no longer enough. Strategies are increasingly being judged on a third dimension: sustainability. But unlike financial measures for risk and return, sustainability issues are subjective—they can mean different things to different investors. Consequently, the equity investment options available are vast and vary dramatically ranging from ESG aware to deep sustainability focus, passive to active, single issue/narrowly defined sustainability objectives to broad-based ones. It’s no surprise that regulators in both the U.S. and European Union are introducing more ground rules to create more clarity in the industry.

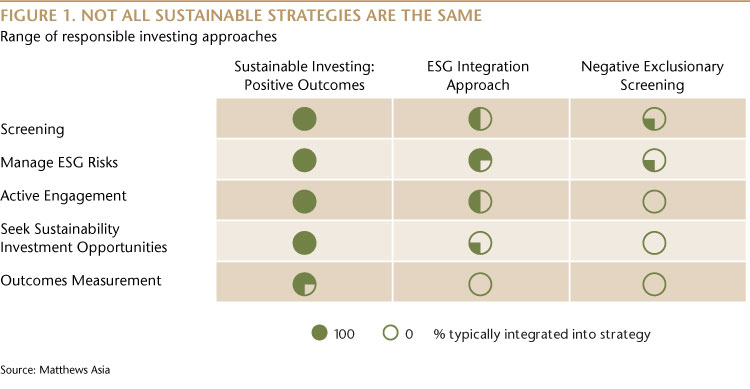

Briefly, responsible investing approaches range from those primarily aimed at avoiding negative outcomes—by screening out, for instance, tobacco and munitions exposure to those focused on mitigating risks like pollution and labor exploitation that can weaken a company’s performance—to those aimed at promoting positive environmental outcomes like renewable energy, sustainable transportation, recycling and social outcomes like financial inclusion, affordable health care and gender diversity.

The case for sustainable investing

We think sustainable investing needs to go further than avoiding and managing risk of negative outcomes and should invest in companies that improve quality of life, and promote positive environmental, social and economic developments. We also believe that identifying, investing in and engaging with companies that are delivering defined positive outcomes is the best way to navigate the ESG landscape. Given the considerable range of ESG approaches, it is imperative investors can distinguish the different types and are comfortable with the strategy they choose.

Focus on intentionality and outcomes

Focusing on companies that are trying to make a better world rather than those that just mitigate sustainability risks is vital. And we believe there are ample opportunities to invest in this universe. For example, there are businesses that operate with a low environmental footprint; offer services and products that reduce environmental impact; provide affordable health care products and services; promote financial inclusion, affordable housing and promote inclusion and strong labor practices and provide societal benefits within the context of the sectors and countries in which they operate.

These companies can be found across a range of sectors including consumer, health care, energy, industrials and financials. But it’s important that a sustainable strategy is committed to holding companies that have demonstrated exemplary or improving business practices while also searching for and engaging with tomorrow’s potential sustainability champions.

It can be challenging for investors to understand or appreciate the impact a portfolio is having on the environment, social well-being or corporate governance. So, it is essential for a best-in-class sustainable strategy to have the ability to measure outcomes accurately and tangible reporting metrics to communicate the sustainable outcomes of the portfolio.

Fundamental insights are the foundation

Sustainable investing is an evolving opportunity, demanding an active manager apply multiple sustainability regulations and requirements to a local set of circumstances.

While Asia and emerging markets offer a deep universe of investment opportunities, ESG research and rating providers have yet to adequately cover these geographies, particularly when it comes to small- and mid-cap companies. Based on our analysis, more than 50% of companies in Asia’s investment universe have no ESG rating assessment. In addition, where ratings do exist, the quality and scope of inputs into the ratings is often limited and they fail to reflect local factors.

In addition to ESG data availability, data integrity also matters and there are significant limitations around the quality, comparability and transparency of third-party ESG research and ratings data currently available. This is particularly relevant in Asia and emerging markets. For example, understanding certain corporate governance intricacies in markets like Indonesia and being able to assess board structures in South Korea is critical.

As a result, there is a vast pool of companies in these markets that have little or no external high-quality ESG and sustainability assessment. At the same time, we believe some of the best sustainability opportunities exist in these markets. What this all means is that there is no substitute for first-hand research and active management when it comes to selecting, monitoring and engaging with sustainability-pivoted companies.

In-depth, on-the-ground analysis edge

Third-party research and fund ratings tend to focus on how effective strategies are at managing ESG risks, what we regard as the ‘outside-in’ approach, rather than their success in focusing on firms that target positive outcomes.

It’s not enough to rely on ‘outside-in’ or integrated ESG strategies. They may screen out tobacco and weapons companies, but they may also invest in oil and gas companies because these firms are committed to technology that may help cap emissions. An ESG strategy may also invest in a large international bank that refuses to fund harmful environmental projects. That’s not going far enough, in our view. They need to be actively promoting positive solutions like financial inclusion services including microlending, micro and small enterprise lending.

In contrast, sustainable investment approaches, what we regard as ‘inside-out’ strategies, look for companies that have internally developed business models geared to delivering positive outcomes, such as diversity on corporate boards, sustainable transportation, or lending to low-income households. And in Asia and emerging markets this very much draws on the experience of the active manager and the engagement they have with companies.

A successful sustainable investment strategy should employ a rigorous two-part fundamental process. One that seeks out companies with exposure to one or more positive outcomes, and then, using fundamental on-the-ground insights, assesses companies further to uncover whether they are good corporate citizens and avoid breaching ESG standards.

The characteristics of this approach are robust research capabilities, on-the-ground engagement, the ability to conduct broad-based due diligence and a local knowledge and understanding of the context businesses operate in.

Investing in emerging and frontier markets using a sustainability approach isn’t easy. The data availability is sparse and the companies that operate in those markets are typically small to mid-caps with less financial and human resources to spare in documenting relevant sustainability and ESG data. But we believe emerging and frontier markets are also where some of the most impactful companies on the planet operate and offer the biggest long-term investment potential as well as the biggest bang for the incremental sustainability dollar.

Active engagement is driving change

In a robust sustainable investing strategy, active engagement with companies drives positive change. We believe building trust and open dialogue with management helps us better understand a company’s plan for a more sustainable business and where necessary gives us influence in helping companies raise their standards or reach their goals.

In our view, through research, due diligence and engagement, specialist managers are well positioned to understand the complexities of sustainability issues in combination with the traditional aspects of investing such as fundamentals and market valuation.

Sustainable investing is about identifying companies which are helping to build a better future. The challenges presented by the shift to sustainable investing is creating opportunities for experienced, active managers to build portfolios of real sustainability leaders.

Sustainable Takeaways

|

Disclosures

ESG considerations are not a specific requirement for all portfolios at Matthews Asia. ESG factors can vary over different periods and can evolve over time. They may also be difficult to apply consistently across regions, countries or sectors. There can be no assurance or guarantee that a company deemed to meet ESG standards will actually conduct its affairs in a manner that is less destructive to the environment, or promote positive social and economic developments than a company that does not meet ESG standards.

There is no guarantee any estimates or projections will be realized.